3 min read

The Inflated Price of Group High Max LTD Plans And What to Do About It

“Between the various loads and pricing actions underwriters apply to high max LTD plans, employers can end up with rates 30% or higher

95% of Group Long Term Disability (LTD) plans sold in the past three years have a maximum monthly benefit of $15,000 or less

89% of these same plans provide 60% income replacement, and over 70% of those plans are “non-contributory,” making the disability benefit taxable to the claimant

99% include an offset for primary and family Social Security disability benefits, meaning the benefit is reduced by Social Security disability benefits

81% provide own-occupation coverage for just two years

Most Group LTD plans do not include bonuses, commissions, or incentive compensation as “covered earnings.” This is potentially the limitation that is most detrimental to key employees. So often, a significant portion of their earnings comes from bonuses, commissions, and/or incentive compensation.

The statistics in #1-4 as provided by Group Market Share (GMS) are based on approximately 120,000 Group LTD plans sold over the past three years with approximately 95% of sold cases in the market represented. GMS is a firm which provides benchmarking and data analysis tools for 20+ U.S. Group Insurance Companies.

Many organizations provide Group LTD Insurance. These plans are valuable and important coverage, but they typically only provide a baseline of coverage for employees. Few organizations take a deep dive into their plan to see the impact it has on ALL employees. The restrictions outlined above may leave an organizations’ most key employees with a false sense of security and leave them under protected. Benefit Managers and Brokers need to understand these restrictions and communicate them so all employees are aware before a disability happens OR can take steps to correct the problem. Below we will explain each of these five restrictions in more detail and then offer suggestions to address the problem.

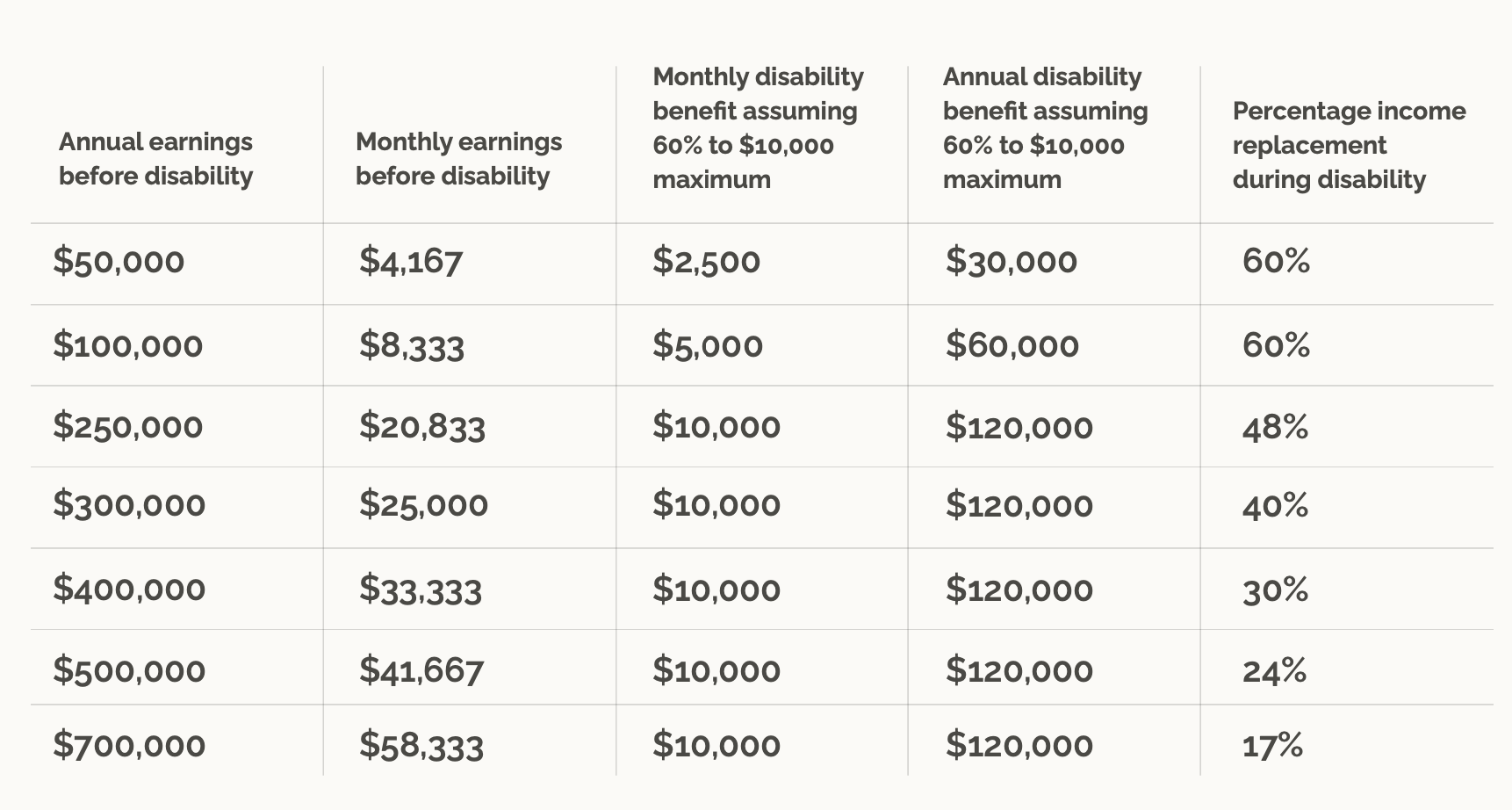

The monthly maximum in a Group LTD plan states the maximum payment an insurance carrier will pay during an individual’s disability. The two primary plan features that determine the maximum payment are the monthly maximum and the maximum income replacement percentage (discussed in more detail below under #2). For example, a plan may pay an individual a benefit equal to 60% of previous earnings up to $6,000 per month during a qualifying disability. With this plan design, if an individual was earning $200,000 annually before disability, the payments during disability would equal 60% of the monthly income (before any potential offsets for a total disability). $200,000 / 12 months = $16,667 X 60% = $10,000. Since $10,000 exceeds the $6,000 monthly maximum, the monthly disability payment to this individual would be capped at $6,000. Here are a few other examples:

The income replacement percentage along with the plan monthly maximum in a Group LTD plan, determine how much the payment to the individual will be during disability. Of the 120,000 plans sold over the past three years and analyzed in the GMS database, 89% included a maximum income replacement percentage of 60%. In addition, 70% of those plans are non-contributory meaning the employer is paying the premium for the plan. IRS rules state that disability benefits received from a corporate paid plan will be taxable to the individual receiving the monthly payments. Looking at the table above under #1, for key employees earning between $250,000 and $700,000, annual disability benefits in this example would be capped at $120,000 AND that $120,000 will be taxable income to the individual under a corporate paid plan.

Almost all Group LTD plans include a provision that states benefits received from the insurance carrier will be reduced by any benefits received from Social Security. The estimated average Social Security disability benefit for a disabled worker receiving Social Security Disability Insurance (SSDI) is $1,280.42 per month, according to the June 2021 figures from the Social Security Administration (SSA).

Own occupation coverage can differ by plan, but at a high level, it simply means that due to sickness or injury the insured is unable to perform most of the duties of the job they were doing at the time of the disability. Two-year own occupation coverage means that after two years, if the insured is able to return to work in a different occupation than the one they are trained to do, benefits could end or be reduced by new income from that job.

As mentioned in #2, the income replacement percentage along with the plan monthly maximum in a Group LTD plan, determine how much the payment to the individual will be during disability. Most Group LTD plans apply the income percentage to the base earnings only in calculating what the disability payment will be. As an example, if an individual is earning a salary of $100,000 plus incentive compensation of $150,000 for total comp of $250,000; under an LTD plan that covers base earnings only, with a 60% income replacement, that individual would receive 60% of the $100,000 (not the total income of $250,000), resulting in just $60,000 of disability payments annually. $60,000 as a percentage of this individual’s total compensation means the individual would be forced to live on 24% ($60k / $250k) of his or her previous total income.

False sense of security

The restrictions outlined above may leave an organizations most key employees with a false sense of security and leave them under protected. Benefit Managers and Brokers need to understand these restrictions, so they can either communicate them to employees before a disability happens OR take steps to address and correct the problem.

How to fill the income replacement gap

The best way to fix the problem is to provide supplemental individual disability coverage to key employees. These plans are structured to provide very high levels of income replacement for key employees. The plans are portable and premiums are guaranteed not to increase. Most programs can be structured so key executives will not have to satisfy medical underwriting or take time to answer a bunch of medical questions. These features can make it simple for Benefit Managers and busy executives to put supplemental plans into place.

Keith Johnson

3 min read

“Between the various loads and pricing actions underwriters apply to high max LTD plans, employers can end up with rates 30% or higher

1 min read

From day one, TIP has been committed to helping Brokers and Benefits Managers identify areas where their key employees are under protected ,...

2 min read

TIP recently welcomed a new team leader with 30+ years in the insurance and benefits business. Keith Johnson is our new EVP of Distribution. ...